- ResiClub

- Posts

- Wall street's big bet on homebuilders creates 12 new billionaires

Wall street's big bet on homebuilders creates 12 new billionaires

A new report by Forbes finds that the bull market for major homebuilders has created 12 new billionaires in the industry.

Today’s newsletter is brought to you by ResiDay!

On Friday, November 8th, in New York City, ResiClub will host ResiDay, bringing together the brightest minds in the housing market. This will be our first-ever one-day conference.

There will be hundreds of influential housing investors, developers, lenders, and brokers who are shaping the future of residential real estate, homebuilding, mortgage lending, and build-to-rent at ResiDay. Several prominent business and real estate journalists will also be there.

The ResiClub team will lead a day of insightful discussions on market trends and strategies impacting the future of the U.S. housing landscape. Expect top-tier speakers, ample networking opportunities, and hours of engaging discussions on the future of the U.S. housing market.

Unlike many other areas of real estate, such as mortgage and commercial real estate, publicly traded homebuilders have shown resilience over the past few years. Not only were large builders able to absorb the mortgage rate shock two years ago—partly by offering affordability adjustments like mortgage rate buydowns, outright price cuts, and smaller homes in some housing markets—but they have also maintained profit margins and net new orders that are at or exceed pre-pandemic levels. Back in May, ResiClub went ahead and declared these big builders the winners of the 2024 housing market, a title we also awarded them in 2023.

On Tuesday, Forbes published an article titled 'The Homebuilders Getting Rich Off America’s Housing Shortage,' finding that the bull market for giant homebuilders has created 12 new billionaires in the industry as their stocks have soared.

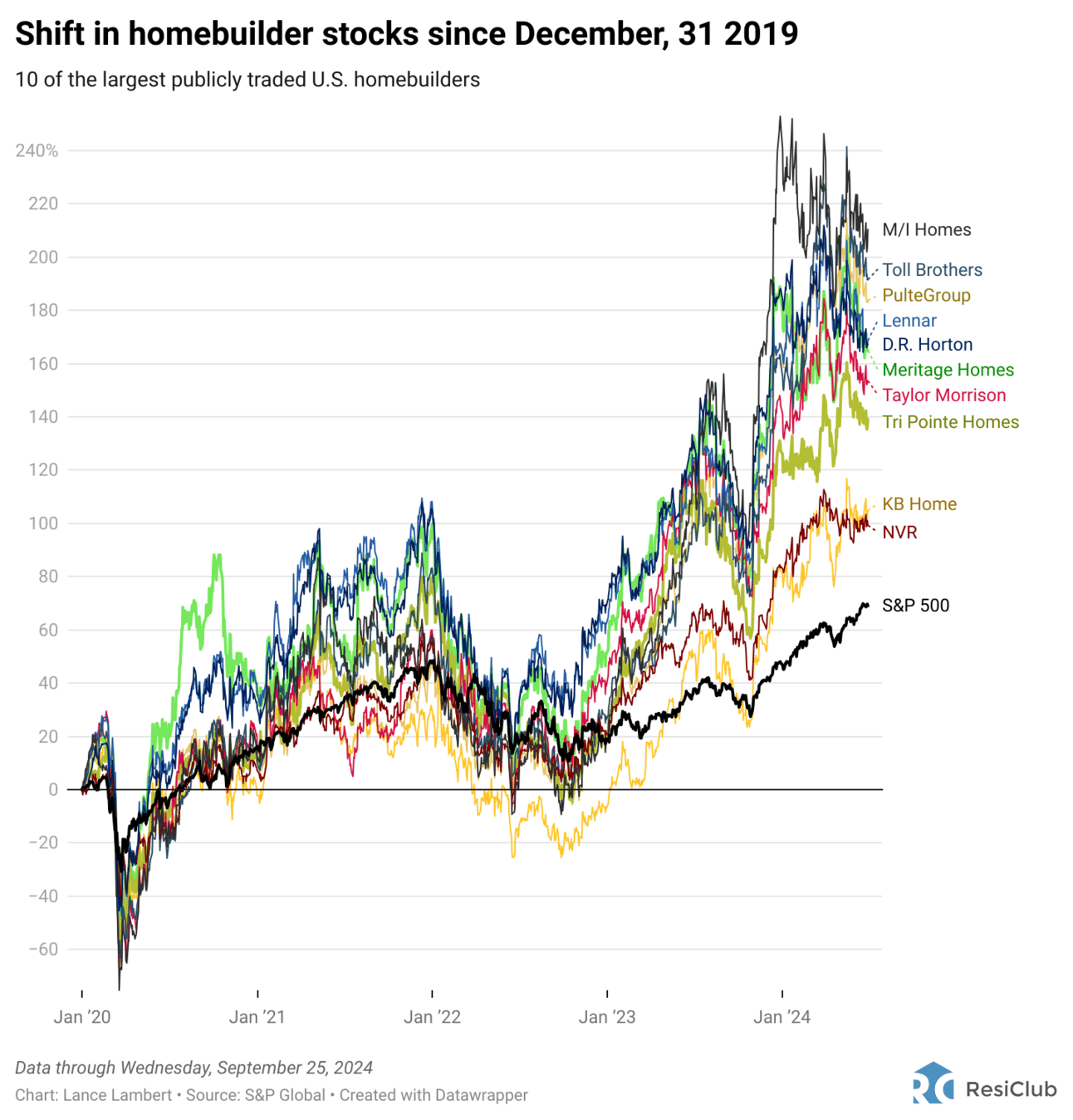

Among the 10 largest publicly traded homebuilders tracked by ResiClub, all 10 have outperformed the S&P 500 Index this decade 👇

M/I Homes —> +210%

Toll Brothers —> +192%

PulteGroup —> +184%

Lennar —> +169%

D.R. Horton —> +167%

Meritage Homes —> +165%

Taylor Morrison —> +154%

Tri Pointe Homes —> +139%

KB Home —> +105%

NVR —> +99%

S&P 500 —> +69%

At the start of the decade, the 10 largest publicly traded homebuilders, as tracked by ResiClub, had a combined market cap of $77.7 billion, according to S&P Global.

As of Wednesday, those same 10 publicly traded homebuilders have a combined market cap of $170.0 billion, according to S&P Global.

Now, let’s check out the 12 new billionaires in the homebuilding industry, according to Forbes👇

Horton family

Ryan Horton: $3 billion

Reagan Horton: $3 billion

Marty Horton: $1.5 billion

“Marty’s late husband Donald Horton founded D.R. Horton in 1978 and by 2002 had grown it into America’s largest home builder by volume. She and her two sons, none of whom work at the business, inherited the family fortune after Donald died in May. The stock is up 70% over the past year,” wrote Forbes.

Miller family

Stuart Miller: $1.8 billion (executive chairman and co-CEO of Lennar)

Jeffrey Miller: $1.4 billion

Leslie Miller Saiontz: $1.4 billion

“Stuart Miller joined Lennar Corp. in 1982 and took over as president and CEO from his father Leonard Miller in 1997. The company, whose shares are up 56% over the past year, builds detached homes and townhouses across 26 states,” wrote Forbes.

Kathy Britton: $2.6 billion

“Britton worked in Texas-based Perry Homes’ sales and land acquisition departments before succeeding her father Bob Perry (d. 2013), the company’s founder, after he passed away. She’s now the executive chair of the privately held firm, which did $2.4 billion in 2023 sales,” wrote Forbes.

Bruce Toll: $2 billion

“Toll and his sibling Bob, who died in 2022, founded Toll Brothers in 1967. Bruce retired as vice chairman in 2016 and runs commercial real estate firm BET Investors, but still owns about 1% of Toll Brothers’ shares, which are up 96% over the past year,” wrote Forbes.

Itzhak Ezratti & family: $1.9 billion

“Ezratti cofounded GL Homes in 1976 and gained momentum in 1992, rebuilding houses after Hurricane Andrew hit South Florida. His son Misha now runs privately owned, $1.9 billion (2023 revenues) GL Homes as president,” wrote Forbes.

Thomas Bradbury: $1.7 billion

“Bradbury sold his first home builder Colony Homes to KB Home in 2003 for $67 million. He founded Smith Douglas Homes in 2008 after KB Home pulled out of Atlanta. Now executive chairman, he took Smith Douglas public in January; shares are up 56% since,” wrote Forbes.

Elly Reisman: $1.4 billion

“Reisman cofounded Toronto-based Great Gulf Homes in 1975 and in 2013 became a director of privately held, $3.6 billion (2023 sales) Ashton Woods Homes, of which he owns an estimated 34% stake,” wrote Forbes.

David Weekley: $1.1 billion

“He launched David Weekley Homes with his brother Dick in 1976 at just 23 years old. The company generated $3 billion in revenue in 2023 and builds in 19 markets across the South, Midwest and Mountain states,” wrote Forbes.

On Tuesday, the Case-Shiller National Home Price Index reported that U.S. home prices rose +0.1% between the June 2024 reading and the July 2024 reading.

That’s a soft print. We've averaged +0.5% for that month-over-month window since 1990. What’s happening? Now that we’re in the seasonally soft period, and the resilient markets in the Northeast and Midwest are done appreciating for the year, regional housing markets where active inventory has jumped near or above pre-pandemic levels—particularly in pockets around the Gulf and the Mountain West—are starting to post mild declines. These declines, in places like Austin, Dallas, Denver, and Cape Coral, will drag down the national month-over-month aggregates we’ll see over the next few months.

Year-over-year: +5.0%

Year to date: +4.8%

Since March 2020: +51.4%

Since the 2022 peak: +5.7%

Over the past week, ResiClub PRO members (paid tier) got these three additional research articles: